When people think about New Year resolutions, “tidying up the books” may not be the first thing that comes to mind. However, if you want to take your small business to new heights this year and beyond, this is exactly where you should start. More specifically, ensuring that your Chart of Accounts is well-organized should be a priority for any small business that wants to stay financially healthy throughout the year.

Before we dive into cleaning up your COA, let’s review the basics.

The Chart of Accounts offers an excellent a way to record all of your transactions for income, expenses, or liabilities. If you earn money it will be recorded in an income account. If you buy business supplies, that transaction will be recorded in an expense account. There’s even an account for liabilities such as mortgages or loans.

Let’s start with a quick description of each:

- Income: This account type includes accounts that generate business for your organization.

- Liabilities: This is what you owe. They require you to give up cash, assets, etc. to settle past transactions.

- Assets: Generate residual value, or represent a specific value. Examples include inventory, property and cash.

- Expenses: Your operating expenses include rent, wages, advertising and the like that you need to incur to run your business. Non-operating expenses are costs that can’t be traced back to a particular revenue line item such as interest expense

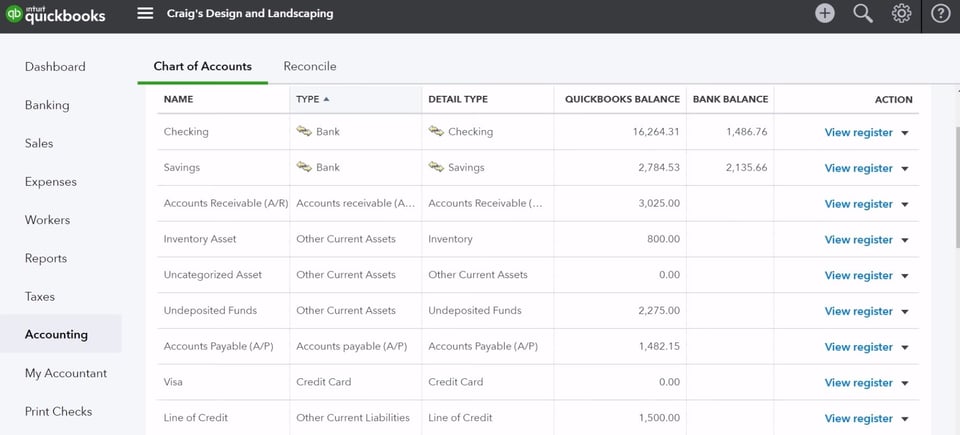

How To Set Up Chart of Account in Quickbooks

Once the Chart of Accounts has been opened you can begin setting up new accounts in two easy steps.

- Press Ctrl+N to open the Add New Account window. On the menu bar at the bottom of the Chart of Accounts window, click Account →New. Alternatively, you can right-click anywhere in the Chart of Accounts window, then choose New from the shortcut menu. Either method will prompt QuickBooks to open the Add New Account window.

- Select the type of Account you want to create, such as Bank for a bank account, and then click Continue. The Add New account window lists the most common kinds of accounts. If you don’t see the account type you want, then select the Other Account Types option and then choose from the drop-down menu shown below.

Benefits of Maintaining a Clean Chart of Accounts

As stated above, routine maintenance of your chart of accounts can have many benefits. Ultimately the goal is to reduce opportunities for confusion and error. The benefits of starting the new year with a clean chart of accounts for your business include:

Ensuring You Have an Adequate Number of Accounts

As your business grows, so does your COA. But bulkiness in your accounting system is oftentimes confusing. It can make reporting more complicated than it need be. It can cause difficulties when trying to compare items across account types.

On the other hand, having too few accounts leaves holes in your accounting processes that could be important for instance, when it comes to taking deductions. If the number of accounts in your COA is not large enough to adequately represent all the accounts you do business with you could be losing out.

Ensuring All Accounts are Named Correctly

Doing a routine internal audit of your COA offers you the opportunity to ensure all items are correctly and accurately named. This helps to eliminate confusion within your accounting system and makes sure all business names are current.

Reducing Error

A well-organized chart of accounts helps to reduce user error by eliminating confusing and promoting simplicity. Furthermore, it allows you to unlock valuable business information in a more timely manner, paving the way for more effective decision-making.

How to Clean Up Your Chart of Accounts

Importantly, you must remember when preparing to organize your chart of accounts that in QuickBooks Online items are linked. If an Expense Account is linked to another item, like a service that you no longer offer, you must first make the service inactive before you can deactivate the linked account. You can work backwards from the account on your chart that you wish to deactivate.

Five primary ways to maintain a clean chart are as follows:

- Sorting

- Make Accounts Inactive

- Make Vendors Inactive (or Products, Services etc)

- Merge Accounts

- Map New Products and Services to Accounts

Sorting

The default setting is to sort alphabetically and by account type. You can use a numerical system in the account name and QuickBooks Online will sort numerically, and then alphabetically and by account type.

Alternatively, you can opt to sort by account number in QuickBooks Online preferences. You can do this by following these steps:

-

Select the Gear Icon > Click Company settings

-

On the left-side menu > Select Advanced > Select the pencil next by Chart of Accounts

-

Click > option Account Numbers

-

Save

Deactivating Accounts

If you’ve been in business for some time and this is the first time you are reorganizing a chart of accounts you are likely going to be marking several accounts inactive that you no longer need. In QuickBooks Online, you can make accounts inactive by deleting them.

To do this, follow these steps:

-

Select the Gear icon > Chart of Accounts

-

Click to highlight the account you want to delete

-

In the Action column on the right, click the drop down and select Delete

-

Click Yes

The good news is that, in QuickBooks, deleting accounts will not change reporting (except for listing the accounts as Deleted). In addition, any transactions previously recorded under these accounts will not be deleted.

However, it is important to note that by default, some accounts cannot be deleted.

-

Credit Card Receivables

-

Undeposited Funds

-

Opening Balance Equity

-

Retained Earnings

-

Inventory/Stock Assets

-

Cost of Goods Sold/Cost of Sales

-

Reconcile/reconciliation Discrepancies

-

Unapplied Cash Payment Income

-

(Sales tax agency name, ie GST/VAT) Payable

Restoring Accounts

If you make a mistake, deleted accounts can be restored. To restore accounts use the following commands:

-

Select the Gear icon > Chart of Accounts.

-

Select Settings icon on the upper right of the COA

-

Check the box to Include inactive

-

Click on the Account you wish to restore

-

Select Make Active on the right-hand Action column

Merging Accounts

This is a valuable tool if you've been using two similar accounts and would like to combine them into a single account.

You can merge accounts within your chart of accounts. But before you do, you should take note that any merger is a permanent action.

-

Start by selecting Chart of Accounts from the Tools menu.

-

Click to highlight on the account you want to merge into.

-

Select the Edit button.

-

Copy Account Name.

-

If a sub-account exists make note of the parent account it is associated with.

-

Select the back browser, returning to Chart of Accounts.

-

Select the duplicate account and click Edit.

-

Paste the copied info in the Name field

-

Make the Detail Type match the merger account.

-

Make sure sub-accounts are associated with the same parent.

-

Click Save, and Yes to confirm merger.

Pro Tip: Unlike archiving or removing inactive accounts, merging is permanent and you cannot undo the process once you hit “confirm”.

You can also merge vendors or suppliers in a similar manner to the steps described above.

Changing Associated Products and Services

As mentioned above, sometimes accounts are linked to products and services. Deleting extra accounts may mean taking a step back to update your product and service categories.

To change which products and services are associated with an account on the chart of accounts follow these steps:

-

Select the Gear > Products and Services

-

Select and highlight Product or Service items to edit

-

In the right-hand Action column, select Edit.

-

Use the drop-down list at the Account field to select the correct new account and include necessary detail

-

To change all previous use of an item, select the box beneath the Account field to update account in historical transactions

Best Practices for Organizing Your Chart of Accounts

The goal of cleaning up your COA goes beyond following the steps to delete and merge accounts. You should also keep in mind the following best practices that will help to optimize the performance of your system and reduces the propensity for error.

Here are some tips for optimizing the cleaning of your COA.

- Start with making a list of accounts that have a zero balance. These are likely unnecessary to the overall functioning in your system. The exception may be parent accounts where the revenue doesn’t roll up.

- Exceptionally small balance accounts and accounts with few transactions may be duplicate accounts that can require merging.

- Audit all account names for accuracy.

- Customize your chart of accounts settings. If you haven’t done this before and you have stuck to default you could be missing out on valuable reporting and data options that would enhance the functioning of your business.

- Decide if you want to use account numbers as a way of prioritizing the order of your COA.

- Link parent and sub-accounts in instances where they haven’t been linked.

Mastering the Chart of Accounts

If you’ve come this far, the perfectionist in you is probably wondering if you have the tools to master your chart of accounts. You’ve come to realize a messy chart of accounts means time and money lost with a systemic lack of efficiency that affects all levels of your business.

That’s because a chart of accounts isn’t just any old list. It’s the foundation of your business. It’s the key to the layers of transactions that make up your company’s revenue and debts. It tells a story through reporting tools.

A good chart of accounts has correctly categorized data siloed into hierarchies that provide an accurate picture of accounts and transactions. Charts of accounts can also be customized to benefit certain industries.

The key to mastering your chart of accounts is to customize the settings to best benefit your business.

COA: Keep it Clean

To recap, a clean chart of accounts comes with significant benefits for small business owners. The benefits include:

-

Fewer errors due to simplification of accounting system

-

Reduces overall bulkiness in accounts

-

Reduces confusion

-

Ensures account names and naming conventions are correct

-

Allows small business owners to revisit organizational system and make determinations about alphabetical sorting or numerical

-

Allows small business owners to ensure that all parent accounts are linked to sub-accounts and all item relationships are correct

When setting out to clean up your chart of accounts, it’s equally important to audit your system in advance and use that information to optimize how you clean accounts. During the organization session, savvy accounting system administrators will take the opportunity to check QuickBooks Online settings are optimized for optimal performance.

If this all sounds like it adds up to a lot of work, you’re right.

Cleaning up your chart of accounts can be a project that takes place over the course of days or even weeks. You may need some help categorizing your COA, creating hierarchies, and tailoring it for optimal performance within your business model.

Hiring your own in-house accountant can get extremely costly. However, outsourcing your accounting and bookkeeping to a firm like Ignite Spot saves you time and money, allowing you to focus on your core operations. With outsourced accounting from Ignite Spot, you won't have to worry about the principles of accounting; you have enough to worry taking your small business to the next level, this year and beyond.

Contact our team today to see how we can help meet your small business accounting needs.

.png)

.png?width=160&height=160&name=Gold%20(1).png)