Is your business changing with the times, or are you still operating in the 80’s? If you're still processing paper transactions, you may be stuck in the past.

The Challenge

If the above sounds familiar, don't worry--you’re not alone. Many businesses are still processing paper transactions today. Why disrupt a process that isn't broken, right? The suppliers, taxes and employees are still getting paid and the customers are still paying, so why ruffle any feathers?

But if you knew that processing one invoice could cost your business $3-35 per transaction, would it change the way you do business? Let me break it down for you below, because I realize it'salmost impossible to digest.

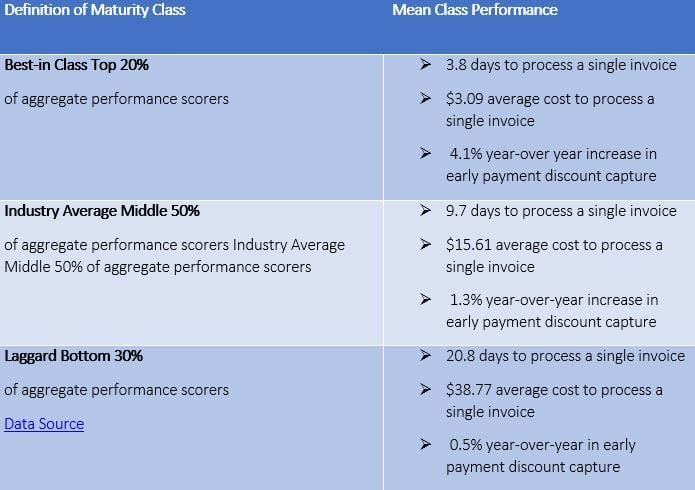

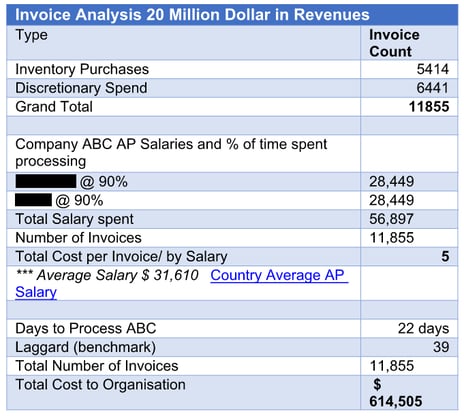

The first table below represents industry benchmarks and how much it may cost an organization to process one invoice. The benchmark measures the days to process. What this essentially means is, how long does it take from the time you receive the invoice in house until the time you pay the invoice?

The analysis (below the benchmark table) is one I completed recently for one of my clients and represents real data.

Benchmarks

When this was presented to the client's senior finance decision makers, they could quickly see the benefits and were blown away with the potential.

Finance is no longer a back-office function. Instead, today’s best-run finance organizations reinvest the time and resources saved by running an efficient organization. Every business is under cost pressure and savvy entrepreneurs are looking for ways they can cut expenses.

How Do I Change my Business Landscape?

Like the best-run operations in every field, more and more finance organizations are looking for ways to streamline their processes. Automation is an obvious strategy. By automating transactional processes, top finance performers are lowering the cost of their financial activities.

The global business landscape is changing rapidly. Business leaders are recognizing that they can no longer think of themselves as cost centers, but look to becoming a profit center. Accounts receivable and accounts payable processes are a fundamental component to business. There would be no business without them.

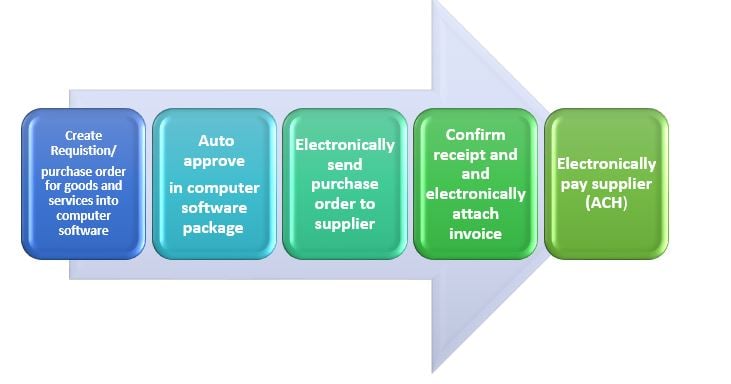

Yet even for large, global organizations, these are slow, opaque processes – labor intensive, bound by paper, fraught with errors, impossible to track and manage. Business leaders look to Procure‐to‐Pay processes to manage cash flow for optimal performance. The analysis referenced earlier is establishing the foundation to build and optimize procure to pay principles. Procure to pay, in short form, is automating a purchase from start to end. The diagram below illustrates the document flow.

Procure-to-Pay Model

Why You Should Implement ACH Immediately

The growing popularity of Automated Clearing House (ACH) for online bill payment is paving the way for a paperless universe where checks, stamps, envelopes, and paper bills are obsolete.

Scary? Well, maybe a little. But the benefits of ACH include reduced administrative costs, increased efficiency, simplified bookkeeping and greater security. Surprisingly, the number of businesses sending electronic transfers is relatively small. Once you see the cost to produce one check, you may want to reconsider your payment options.

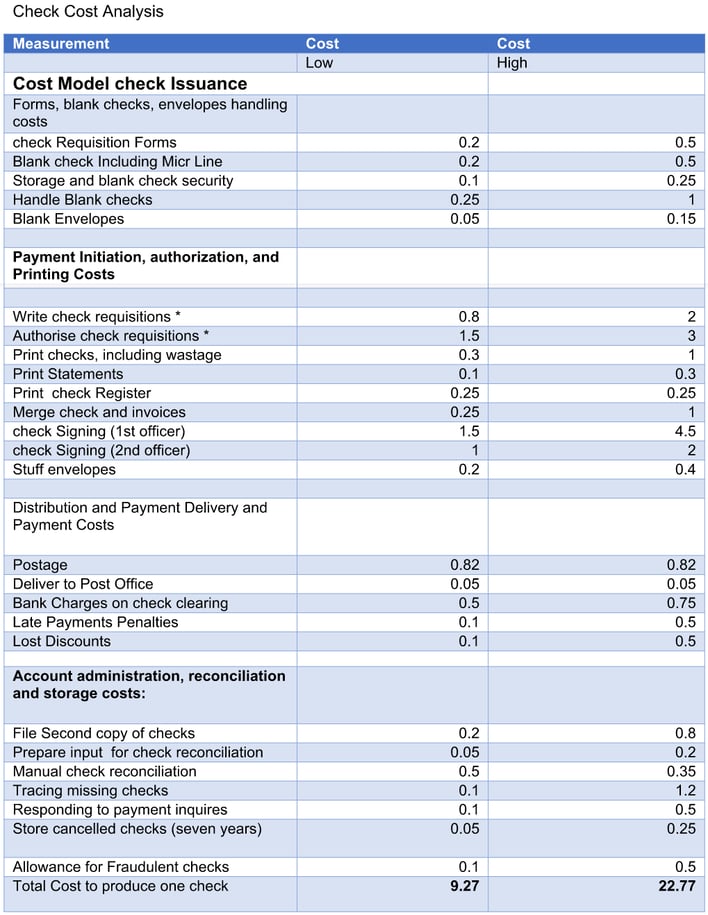

Check Cost Analysis

The analysis above illustrates that a check can cost between $9-23 per transaction.

If we used the same example of 11,000 invoices, the total cost would equate to $99,000 for the lower end and $253,000 for the higher end!

The numbers illustrate an interesting reality. Are you blown away by what this may be costing your business?

So why haven’t more businesses conformed? If ACH is so great, why doesn't everyone use it?

In reality, many businesses are unaware of what the cost is to processing a check. This is often one of the most overlooked processes in business.

Another element for not implementing ACH is plain old fear. Businesses are still skeptical with the security requirements of electronic data transfers. You can rest assured, though; the U.S. Government monitors EFT compliance through Regulation E of the Federal Reserve Board, which implements the Electronic Funds Transfer Act (EFTA).

Regulation E governs financial transactions with electronic payment services, specifically with regard to disclosure of information, consumer liability, error resolution, record retention, and receipts at electronic terminals.

ACH transfers account for the online bill payments you make and the direct deposits you receive, along with other transfers. Did you know that ACH volume has grown to $25 billion in payments and $43 trillion in value?

If you're warming up to the idea of implementing ACH transactions in your business, the tips below will give you more insight to how it works along with definitions of some of the most common terms.

What is an ACH transfer?

If you’ve sent or received money online before, odds are that an Automated Clearing House transfer was involved. An ACH transfer refers to any electronic transfer of money between different banks that goes through the Automated Clearing House network, one of the biggest U.S. payment systems.

These types of transfers do not include external funds transfers, person-to-person payments, bill payments and direct deposits from employers and government benefit programs. Many transfer providers you're already familiar with, including banks and third-party apps like PayPal, use the ACH network.

Types of ACH transfers

ACH technology is processed automatically or manually depending on your preference.

ACH debit transactions: involve money getting “automatically pulled” from your account. When you set up a recurring bill payment like a utility, the company can withdraw the amount that is owed each month. This is great for those of you that incur a recurring charge from clients each month; just set up the monthly "pull" from the client's account and forget about invoicing forever!

ACH credit transactions: lets you “manually send” money online to accounts at different banks, either accounts you own or friends’ and family members’ accounts.

How long does it take?

ACH network operators process transfers in batches three times a day, so the delivery of ACH may take several business days. Business days are the days the bank is actually open.

Financial institutions can opt to have ACH credits processed and provided either within one or two business days. In contrast, ACH debit transactions must be administered by the next business day. Once the funds has been received by the authorizing bank or credit union, they might also have a required holding period. The delivery times may vary depending on the bank you work with.

What is this going to cost me?

The fees are typically free for generic transactions. These transactions may include ACH debit transfers, including payroll direct deposits and most bill payments. If you need expedited bill payments, there can be fees.

Transferring money between your bank accounts isn’t always free. If you have accounts at multiple banks and you want to move money between them online, you can do what’s called an external funds transfer. This is a type of Automated Clearing House transfer banks typically offer through mobile and online banking. It’s different from other ACH transfers like direct deposits, bill payments and person-to-person transfers.

Person-to-person payments that you initiate through your bank or third-party apps like PayPal can cost small fees, depending on the platform and payment method.

ACH transfers vs. wire transfers

While ACH transfers cost a few dollars, sending a bank wire transfer within the U.S. ranges between $20 and $30, and there is generally a fee to receive a wire. The wire network processes transactions in real time, so you can generally expect U.S. wire transfers to be delivered the same day.

If your business is sending or receiving large sums of money that are time sensitive, then a wire transfer is the way to go. Just remember that you will be paying more for those transactions.

What changes are coming soon?

New rules were introduced by the National Automated Clearing House Association that went into effect last September. They will move toward three ACH network processing times daily instead of just one. This will occur in three phases and will make widespread use of same-day delivery possible by March 2018.

Restrictions on external funds transfers

- Amount limits: You may have a daily and monthly cap on how much money you can move.

- Cut-off times: After a certain hour, a transfer won’t be processed until the next business day. If you send money on a Friday, for instance, processing might not start until the following Monday.

- Fee for insufficient funds: If you don’t have enough money in your account, your bank might charge you a fee and stop the transfer.

- Not often available for international transfers: Your bank probably won’t allow consumer ACH transfers to banks outside the U.S.

- Transfer limits for savings accounts: These online transfers fall under the general federal restrictions, which limit the combined number of certain withdrawals and transfers from savings accounts to six per month.

ACH transfers are an efficient secure way of sending and receiving money that can save your business time and money in the long run. Always work closely with your bank to understand the fees associated with ACH. You don’t want to be surprised any additional fees or longer delivery times than you anticipated.

With all of the information provided here, are you still happy with the status quo, living in the dark ages of paper? Just by implementing one initiative like ACH, you could save your business big dollars with minimal money, time and resources. You can quickly be ranked best in class and celebrate the savings!

Ready to start mastering your cash and living a better life? Use our free Master Cash forecast tool below.

.png)

.png?width=160&height=160&name=Gold%20(1).png)