Do you remember the optimism we all had at the beginning of 2020?

Here’s a reminder:

[Source: January, 2020 SERP results — “investor optimism for 2020”]

This was supposed to be our collective year. A strong start to a strong decade. But then, well, about a thousand things went wrong for all of us (think global pandemic, massive unemployment, and a volatile economy).

It's time to adopt an agile finance model while planning for your business in the coming year. Financial agility helps you bounce back from whatever surprise expenses that 2021 throws at you.

A new American Institute of Certified Public Accountants report defines agile finance. It says companies who are financially agile have the ability to “make informed decisions swiftly about how to adapt to rapid and constant changes and to then implement new strategies. In addition, they need to be able to manage performance nimbly, constantly monitoring what is working and what is not working and redeploying resources to where the returns or opportunities are best.”

Plainly put, a business’s finances must always be ready to handle, well, anything.

Sound ambitious? The first step to achieving this aspiration is to get familiar with the most common expenses that surprise unprepared business owners. Here, we’ll show you what those unexpected costs might be, why preparedness matters so much, and how to trade your financial fragility for agility.

The 5 most common unanticipated business expenses

Common surprise costs include employees, finance, contracts and compliance, operations, and sales and marketing. Your company is unlikely to be affected by a volcano eruption or, say, an EMP attack. But you will face disruptions, and recovering will cost you some resources.

1. Employees

Business leaders often have to make unexpected investments in their workforces. That could take any of the following forms:

- • A star team member asks for an unscheduled raise or bonus.

- • A bad hire requires excess development and then quits anyway.

- • A worker is on family leave and must be replaced temporarily.

- • An employee leaves the company and conspires to take customers along with him.

Due to the COVID-19 pandemic, many businesses were forced to pivot and bring their operations (and workforces) entirely online in the wake of shelter-in-place orders. As employees shifted to working from home, businesses inevitably incurred costs during this transition, from new software to new servers to stipends that helped employees set up a home office.

2. Finance

Your accounting department (even if that’s you) also requires spontaneous financial coverage sometimes. That might mean

- • you pay for a future product or service that is never delivered;

- • the interest rate on one of your loans starts creeping up, requiring an increase in budget allocation;

- • you find that your taxes were prepared incorrectly, and now you owe penalties;

- • your insurance company raises its premiums; or

- • money that’s owed to you becomes unrecoverable, creating bad debts.

3. Contracts and compliance

Your careful scrutiny of all contractual agreements should safeguard you from surprise costs, right? Unfortunately, no — occasional troubles arise in this department, too.

For example, a contract payment slips through the cracks, incurring hefty late fees. Or a competitor steals your intellectual property, and you must go to court. Maybe (hopefully never, but maybe) you discover a team member has been breaking the law to overachieve on goals, and now you owe.

You could also unexpectedly be sued for the following:

- • Internal harassment or discrimination

- • An injury on your premises

- • Negligence

- • A contract violation

- • Violation of wage laws

While compliance mea• sures exist to safeguard against unexpected business expenses, sometimes the unthinkable is impossible to prevent.

4. Operations

Running your day-to-day operations is risky — but rewarding — business. Common operational glitches may include a scenario in which a mission-critical piece of equipment breaks or underperforms, or your commercial property manager raises the rent.

In 2020, business travel for millions of business leaders was disrupted. And even if it’s not the pandemic next time, unanticipated weather and human error can still have you scrambling for alternatives and booking costly nonrefundable doubles.

Here are some other common surprise expenditures you might face:

- • A premature software upgrade, when you outgrow your programs and must subscribe to the next tier of service sooner than expected.

- • A surge in consumption. If your utilities fluctuate more than usual in an exceptionally hot or cold year, it’ll cost you.

- • An occurrence of internal theft. According to the U.S. Chamber of Commerce, 75% of employees admit to having stolen at least once. Further, half of those who admitted internal theft say they steal repeatedly.

5. Sales and Marketing

You know that attracting customers will cost you, but did you know that your marketing activities can be the source of some surprise expenditures? Commonly, companies invest in an advertising medium or channel that delivers no leads or ones that are low-quality. It’s an unanticipated waste.

Another common scenario is when a business leader speaks at a conference at which they’re sure to acquire lots of connections — but the organizers cover only basic expenses. Sometimes, sales teams ask their company’s leaders for permission to send gifts to clients. Or a favored digital marketing channel unexpectedly doubles its price for targeting you can’t get anywhere else.

Budgeting for advertising spend is smart, but including a cushion for spontaneous coverage of surprise costs is even better.

Less common expenses that businesses should still keep in mind

The following scenarios are very unlikely to come your way. However, the important lesson is that these events do happen, they cause numerous unexpected business expenses, and some companies are capable of weathering them while others are not.

- • Natural disasters, like Hurricane Laura or the current California wildfires

- • A banking industry collapse

- • Mass violence

- • State-based cyberattacks

- • Trade wars

- • Infrastructure failure

- • Terrorist attacks

- • A global health event, like the recent pandemic that disrupted supply chains and forced businesses to shutter physical properties

Again, these are all catastrophic and rare events. But the last event on our list should illustrate that financial agility and readiness are just as important as optimism.

Being financially agile prepares you for crises and unpredictable expenses

Analysts at PwC report that 73% of executives expect to encounter at least one crisis in the next three years. Here’s how agile finance benefits leaders navigating upheavals.

Leaders who are ready aren’t surprised — and they can act early

According to a 2019 Harvard Business Review analysis of over 5,000 businesses, “Companies that proactively. . . discussed the possibility of a downturn in their earnings calls before the economic recession officially began in Dec. 2007—achieved 6 percentage points better Total Shareholder Return.”

Experts have been warning of a global health event for decades. Leaders who don’t listen to these experts couldn’t have seen it coming. Those who prepared financially were unsurprised and were able to act early. That’s because financially agile companies are aware of their options and can choose the best one to suit any scenario:

- • Some enterprise security software publishers beefed up their customer support centers in anticipation of a surge of new work-from-home security concerns.

- • Some gyms and private education providers kept their clientele from gravitating to more innovative instructors by beating the competition to online production and publishing.

- • Some grocers foresaw a surge in grocery retail and a slump in restaurant sales and had a cash flow fit to hire restaurant workers to meet both needs.

- • Some brands that relied on in-person conferences for lead generation had the reserves to invest in video production for standout digital events.

It will look different for every sector, but practically, agile finance gave brands choices that allowed timely pivots.

Leaders who are ready have cash on hand

Financially fragile, unprepared businesses have found that when unexpected challenges arise, they can’t pay their immediate bills. Research published in the Proceedings of the National Academy of Sciences (PNAS) indicates that the businesses are often forced to lay off employees.

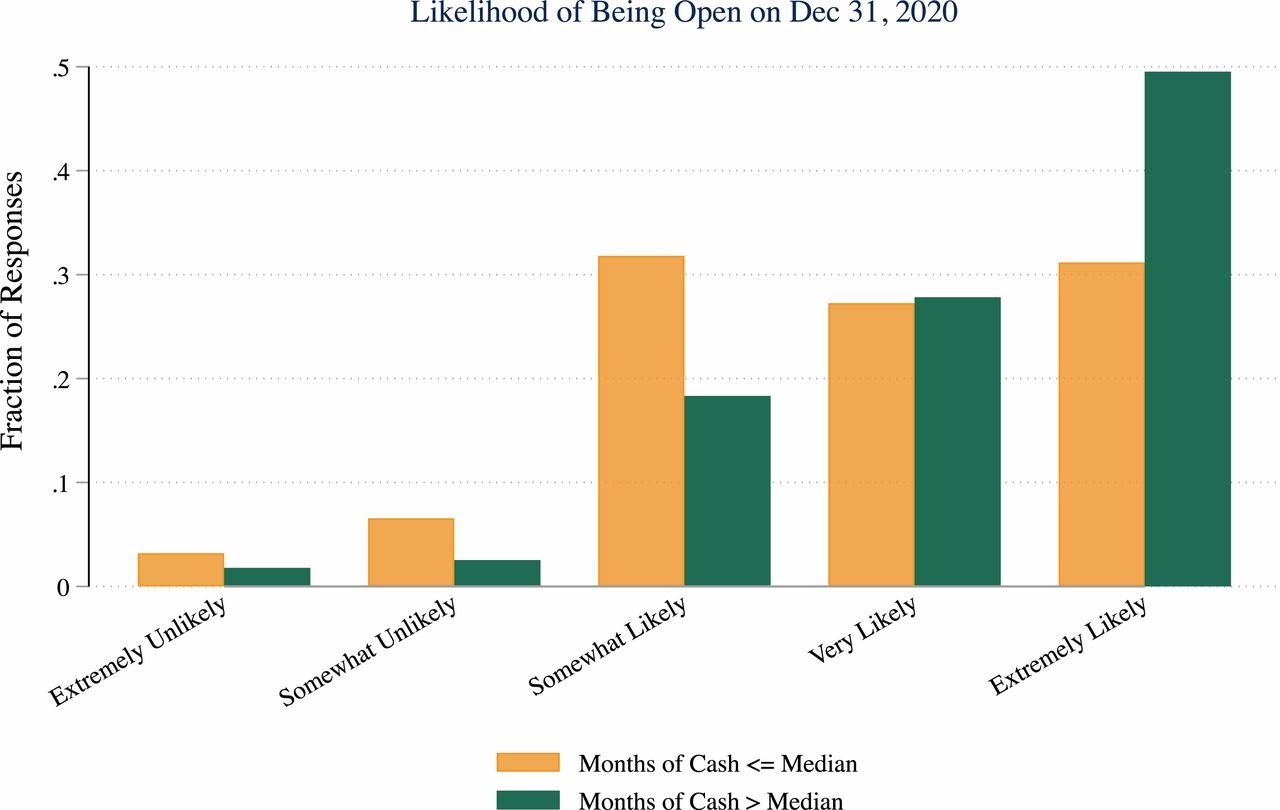

The PNAS study also shows that firms that have more cash available are more optimistic that they’ll survive 2020. In years like 2020, unprepared businesses can and will go bankrupt.

Source: The impact of COVID-19 on small business outcomes and expectations, Proceedings of the National Academies of Sciences of the United States of America

We recommend having at least three to six months of operating costs on hand at any given time. When you encounter an unexpected series of expenditures, you can tap this fund to weather the storm. Once your financial situation stabilizes, you can rebuild this fund to help cover future unexpected expenses.

Leaders who are ready can do the right thing

When presented with the chance to “do good” by helping others amid a crisis, those with agile finance practices have a cash reserve to do exactly that, becoming standout examples to emulate. By contrast, unprepared businesses must themselves lean on unreliable outside help.

Sadly, that doesn’t always pan out.

Of the 31 million small businesses in our country, U.S. News & World Report declares that only 4.2 million received government assistance in the form of the pandemic rescue funds.

Adopt an agile finance operating model with Ignite Spot

Experts at the Boston Consulting Group found that a company’s actions, not external circumstances, determined whether they were able to thrive during an unexpected and costly event like an economic downturn. That means it’s not sheer luck that some food-delivery platforms, at-home gym-equipment providers, and streaming services have flourished during the pandemic. No, it’s not luck, it’s agile finance.

Practically, financial agility is the knowledge of where you’ve been on key financial metrics, as well as where you’re headed, assuming no changes are made. It also means knowing what financial changes are available to you as options. It means your financial managers are alert and knowledgeable about the early signs of both trouble in the market — and opportunity.

Further, financial agility means you have tangible flexibility (that is, cash on hand) to execute both minor trajectory changes and massive pivots. And it means you have the mental and emotional fortitude to decide upon those changes and see them through.

Finally, agile finance is never satisfied. It’s constantly looking to improve its own agility.

At Ignite Spot, we’ve seen that financial agility is a competitive advantage that stems from decisive, well-informed preparation. And working with an outsourced accountant and CFO from Ignite Spot can give you exactly that.

Working with a financial agility expert can:

- • Help you change your mindset toward continuous improvement in crisis recovery.

- • Help you assess your current capacity for various scenarios.

- • Help you analyze potential “what-if situations.” Our experts study scenarios based on asymmetry. That is, we compare the probability of an event against the costs of preparation and prevention measures so you can decide whether to invest in risk mitigation.

- • Help you learn to calculate ROI. Calculating ROI incorrectly (a common flub) causes surprises when investments end up costing instead of earning returns.

- • Help you create plans based on the above scenarios and their findings.

- • Help you determine which team members you’ll authorize to make decisions if and when the time comes to make them.

- • Help you decide how and where to arrange key resources based on impromptu accessibility and safety.

From mishaps to mayhem, you can be more ready

Don’t be surprised when the next speed bump or globally destabilizing event appears. Go from fragile to agile today with an Ignite Spot expert in your corner. To get started, book a free session with a virtual CFO.

.png)