There's a lot of accounting tools out there to help you save time as an entrepreneur. That is the goal, right? I'm assuming that you want to maximize your time so that you can grow your company and make a bigger dent on the world. So lets look at some of the technology available to you.

With all of the tools out there, there's no reason for you to be slogging around in piles of paperwork and hours of accounting tasks. Here are a few ways you can cut down on the clutter and get on top of your financial A-game.

Step 1: Bill.Com

Bill.com is a SAAS solution that makes it possible for entrepreneurs to manage their accounts payable and accounts receivable functions. If you struggle with keeping the bills paid, would love to streamline your invoicing, or want approval processes over the inflow and outflow of your cash, this is a great tool. We use it at Ignite Spot for a lot of our clients to help them make the most of the cash positions. And yes, it syncs with Quickbooks.

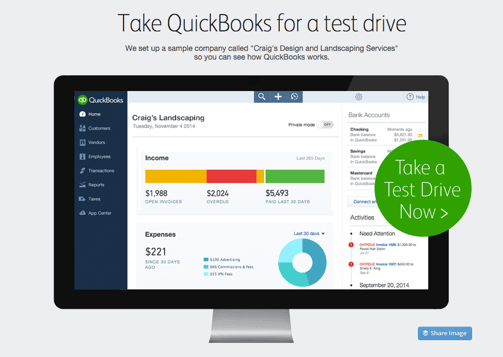

Step 2: QuickBooks Online

A lot of people believe that the desktop version of QuickBooks is the way to go because it has more features than the online version, and while that may be true, the online line version has come a long way. There are a lot of reasons you should consider it as a solution for your company. First of all it's cheap. Here's the link to the pricing page. Essentially it costs between $8 and $25 per month as of the time of this writing. That's not bad for a solution that keeps you organized. It also has some great dashboard reports and the ease of access online is super convenient. Unless your business is extremely complicated with inventory or orther high-level accounting needs, this may be a great fit for you.

Step 3: ProfitSee

For those of you who are interested in a financial dashboard that digs into the deep waters a bit more, make sure to check out ProfitSee. It syncs with your QuickBooks file and creates some great reports to help you plan, manage, and even forecast your business. Yes you can do cashflow forecasts with this one and it's great.

Step 4: A Playbook

Alright, this is where the purists in the room scream at me. I'm sure you were expecting everything to be technology based, but I couldn't help but throw in a paper tool. A playbook is the step-by-step guide to doing the accounting for your company. Now before you respond to me with a bunch of hate mail about how you can't stand doing stuff like this, let me tell you that it's one of the best investments of time you'll ever make in your company. We create playbooks for every client we have and they're extremely valuable. When you have to introduce someone to your system, there's a minor learning curve. It also forces you to look at some of your processes and realign them to make them efficient. You can get this done in a single day and your accounting will function much better.

There are a million more accounting tools out there to help you save time, but these are a few of my favorites. Implement them and your business will be running on all financial cylinders.

.png)

.png?width=160&height=160&name=Gold%20(1).png)