Analysts at CB Insights report that 40% of small businesses are still penalized for their lax or inaccurate approach to payroll.

If you’re part of the other 60%, congratulations: you’ve graduated to the advanced ranks of well-positioned companies. From here, you can figure out how to do payroll in a way that builds wealth and generates real momentum. Here’s how.

Shift Payroll to the Finance Department

You probably wore many hats when you were getting your business up and running. Recall your first, second, and third hire. If you’re like most businesses, those new folks ran sales, operations, and either legal, finance, or customer retention. At some point, all growing small businesses bring on a human resources person who knows how to do payroll, and that person usually owns the task.

You can see the progression: as you scale, it’s tempting to allow the human resources team to continue administering payroll.

But payroll is the largest transaction on your general ledger (if not, then it’s close). Considering its sheer size alone, only a corporate finance expert should handle reconciliation and compliance with tax laws.

Obviously, human resources will still manage your team’s development. And when finance is handling payroll, they can still feed HR any relevant talent-development and people-management information to inform personnel strategy.

In fact, MIT Technology Review analysts say that healthier, more collaborative teamwork between finance and HR is more than a nice-to-have; it’s an “overwhelming” strategic necessity. When payroll is managed by finance, they can collaborate with the HR team on pertinent intelligence, such as the following:

- • PTO: Who’s accruing time at what rate, and who’s not taking time away (or taking too much)?

- • Overtime, bonuses, and minimum wage: Regional regulatory nuances for all three of these require an accountant’s expertise and input.

- • Labor trends: Are new hires taking more and more time to onboard? Is chronic tardiness resulting in time theft? Do star performers churn because of an inferior benefits package? Finance can spot these, and HR can handle them.

- • Expense account data: Human resources people want an overview and the ability to drill down for details. Compiling this type of data narrative is a financial team’s superpower.

- • Liens and wage garnishments: Keeping payroll in finance helps you avoid penalties and fines by ensuring that you comply with pay-seizure policies. Meanwhile, the case can be given to HR to inform how employees receive debt-management training, counseling, and other resources.

What if you prefer working with an outsourced accounting service provider? Easy: include payroll in your list of requirements. As one HR professional eloquently said, “Outsource it . . . there is no need for payroll to be done in house.”

Just ensure that you’re relying on an accredited finance team, not a basic “payroll administrator.” Many payroll service providers loop in a team of CPAs to ensure accuracy anyway. So if you let your outsourced accounting team handle the transactions from the start, you eliminate the intermediary.

Shift payroll to the finance team. This move ensures that your company’s largest transaction informs strategic decisions.

Embrace New Tools to Cut Costs

Finance people (good ones, at least) love to find ways to maximize business spend. And cutting payroll costs is one of our favorite ways to do exactly that.

Thankfully, technology is helping companies do more with less. When paired with a smart strategy, the right solutions turn payroll into a number of cost-cutting opportunities. For example:

Web-based workforce management (WFM) tools

These solutions equip leaders to more intelligently organize and manage team members. The result is fewer redundancies and a more efficient output. These tools also create a more informed and capable management:

- • At Ignite Spot, we use and recommend T-Sheets.

- • Read about WFM options from other business leaders on software review sites like G2.com.

AI-powered payroll automation

These tools remove the need for manual payroll data entry and processing. Choose an automation tool that calculates deductions, such as medical and dental insurance, and administers benefits without human involvement. The result will be reduced labor costs associated with completing these tasks, as well as fewer penalty fees and lawsuits from inaccurate human input. Plus, you’ll enjoy having a management team that is less stressed and has more time to handle anomalies and nuances brought up by their subordinates:

- • Hands down, Gusto is the payroll automation tool of choice here at Ignite Spot. Gusto streamlines our payroll work while ensuring that we stay compliant.

- • Experts at Business.org agree, but you’ll still benefit from their comparison of the other payroll automation options available.

Express pay administration and disbursement

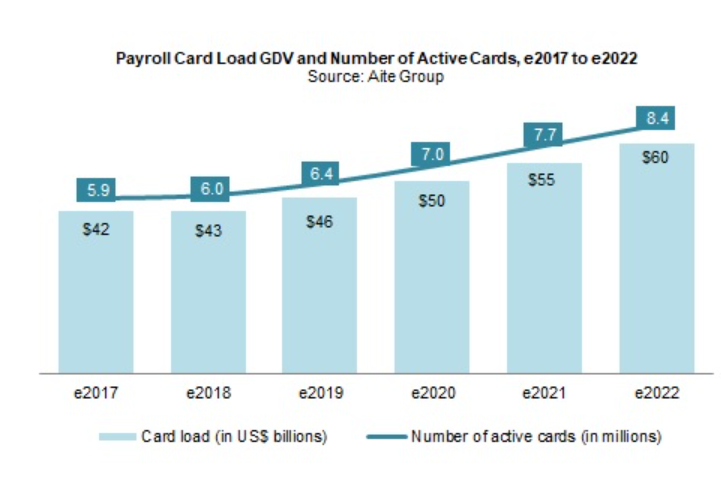

More and more companies are paying employees in real time. The perk is so new that it still has a number of names, including “instant access,” “pay flexibility,” and “express pay.” But experts say it’s here to stay. Express pay simply means employers are learning how to do payroll in a way that gives workers their earned wages immediately or on demand.

Coverage from Employee Benefit News reports that employers offering this benefit experience enhanced ability to attract applicants, lower employee turnover, improved time-clock compliance, and even an increase in requests for more hours. The reciprocity makes sense: as employees enjoy the immediate fruits of their labor, their gratitude and motivation show.

Interestingly, analysts predict the trend will continue gaining steam. This is an offering especially beneficial for the 78% of workers living paycheck to paycheck and those in unbanked or underbanked groups. The best part is, you can expect your own long-term costs to reflect the move: PCMag’s investigative writers agree that you’ll reap a thankful, more engaged workforce—with lower turnover.

- • The express-pay solutions market is hopping. Branch, PayActiv, DailyPay, and Even are all competing for your business right now, which means flexible features and affordable price points.

Source: Aite Group 2017 Impact Report

Better expense management

An Ignite Spot accountant recently advised his customer to try a new expense-management solution, and the company cut their corporate spending by 15% almost immediately. You want to empower your people to spend what they need to do their jobs well. But you also must monitor and rein in misguided or excess spending immediately. Until now, the only answer has been costly human oversight:

- • By far, Ignite Spot accountants recommend Divvy above other tools. Divvy’s site calls it “the #1 corporate card & expense management platform.” Other options include Concur, Expensify, and Zoho Expense.

Many of today’s technological tools cut business costs overnight. Savings like this affect your cash flow immediately, putting more wiggle room in your schedule and budget for more wealth-building activities.

Stay Aware (and ahead) of payroll trends

While you don’t need to adopt every fad, it’s crucial for business decision-makers to stay informed on management trends that could affect payroll.

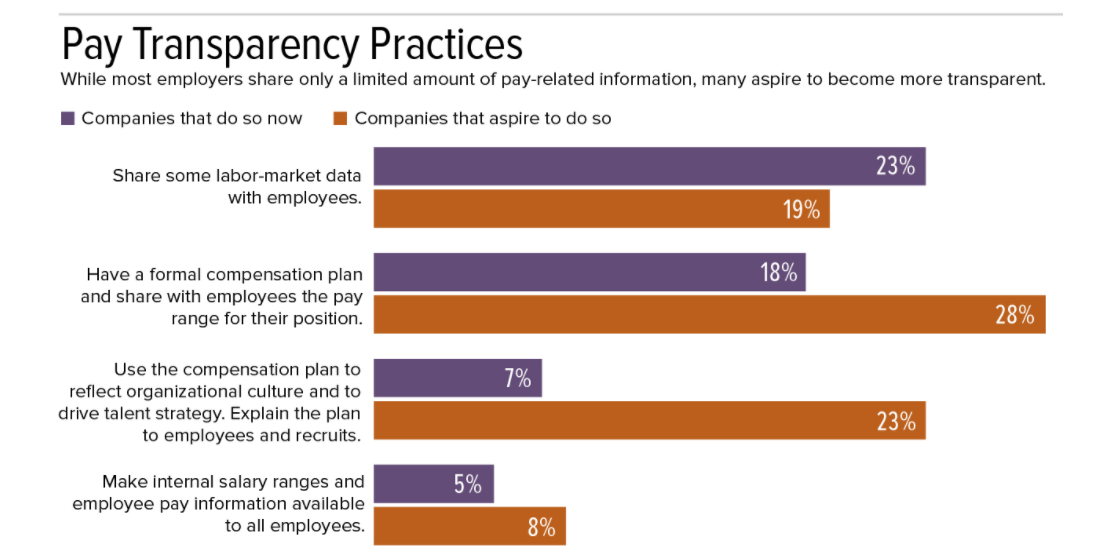

Transparent pay is one of these trends. A survey conducted by Glassdoor analysts found that 90% of their users say it’s important that they work for a company that’s transparent. Still, though, a research report from the Institute for Women’s Policy reveals that only 17% of private businesses have adopted pay transparency.

“Employers who have yet to expand and become more transparent in their pay communication with employees will need to do so as top talent will demand it,” says Catherine Hartmann, North America Rewards practice leader at Willis Towers Watson.

If you’ve considered opening pay data to your team, you’re not alone. More companies aspire to illuminate their pay practices (to attract and retain top talent) than actually do now:

Source: PayScale, 2019 Compensation Best Practices Report via SHRM

Check out this tactic in the wild: Buffer, a company that makes social media marketing tools, made all their employee’s salaries and titles public. They did it not to increase interest in their open positions but because they felt it was the right thing to do. Within 30 days, the company saw a doubling of applications for open roles, a direct result of disclosing their payroll specifics.

Another trend some CEOs saw coming is the arrival of flexible work. This trend was greatly accelerated by the upheaval of 2020. Handled correctly, flexible work can save businesses illimitable money in the following ways:

- • By eliminating geography and commute as hindrances when hiring. Again, the economic shutdown accelerated this trend, making “diverse and dispersed” (finally) the new normal.

- • By offering the best of both worlds to employers and skilled workers alike. Contract-to-hire arrangements allow firms and their new hires to acquaint themselves on the job. That way, leaders can onboard without the risk of a payroll-expense-inflating “bad hire.” Almost two-thirds (63%) of employers plan to move gig workers into permanent roles, and NPR reports that contractors may account for as much as half of the U.S. workforce by 2030. [Tweet this fact]

- Share This:

- • By creating their own benefits packages. You may pay more in wages for a contractor, but you can easily spend much less in costly benefits offerings. That’s because 1099 workers are responsible for their own medical insurance, vacation, and education.

Your payroll can be used to defend your business against hazards while also exploiting opportunities. The trick is to keep your eye on industry headlines and trends.

How to Do Payroll Better Now: Talent, Tactics, and Tools that Fit Your Needs

Hearing about trends and new, powerful software solutions can be overwhelming. Of all the new developments, what is most applicable to you? Get help parsing the information available by partnering with an outsourced accounting team that can pair their expertise with your unique business and goals.

Download our pricing guide to level up your current accounting processes and transform payroll from a costly task into a wealth-building engine.

.png)

.png?width=160&height=160&name=Gold%20(1).png)