What are debits and credits?

Every business transaction impacts your company’s financial statements at the monetary level. Transactions are recorded into two accounts—debits and credits—to create a balanced financial picture. Of course, it’s a little more complicated, and each has subtypes and nuances.

Understanding Debits

In the accounting services world, a debit increases assets (e.g., cash) or expense accounts (e.g., utilities) or decreases liabilities or equity. You record debits on the left side of your accounting ledger.

Untangling Credits

A credit increases a liability (e.g., loan) or equity account (e.g., capital) or decreases an asset or expense account. You record credits on the right side of your accounting ledger.

How do debits and credits work together?

Debits and credits are fickle little creatures. Credits increase your account balance while debits reduce it ... right? Not so fast. That's only true some of the time in accounting.

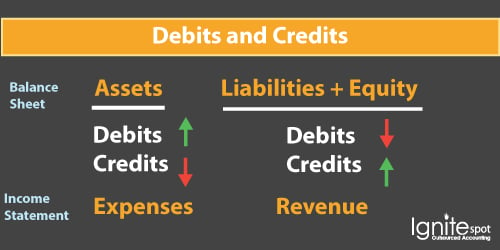

Debits and credits break out into four pieces: assets, liabilities and equity, revenue, and expenses.

Asset Accounts:

Asset accounts are on your balance sheet, and they’re pretty straightforward. When you debit an asset account, the balance goes up, but when you credit an asset account, the balance goes down.

Asset accounts come in three types:

Liabilities and Equity Accounts:

Liabilities and equity accounts are also on your balance sheet. Just take the idea behind an asset account and reverse it. When you debit your liabilities and equity accounts, the balances go down, but when you credit them, they go up.

Liability accounts come in three forms:

But so do equity accounts:

- Additional paid-in capital

- Owner distributions

- Owner contributions

Revenue Accounts:

Revenue accounts are listed on your income statement. A revenue account mirrors liabilities and equity in one key way. When you debit a revenue account, the balance goes down, but when you credit a revenue account, the balance goes up.

Revenue accounts can be one of two types:

- Sales of services

- Sales of products

Expenses Accounts:

Expense accounts are also listed on your income statement. They mirror assets in terms of debits and credits. When you debit an expense account, the balance goes up, but when you credit an expense account, the balance goes down.

Expense accounts fall into three categories:

- Rent

- Payroll

- Cost of goods sold

Who needs to know how to navigate debits and credits in accounting services?

Luckily for you, if you have an accounting services partner, it’s not necessary to get too caught up in the intricacies of debits and credits. Your team will handle the heavy lifting! Of course, a basic understanding never hurts. That said, bookkeepers and accountants using double-entry accounting rely heavily on debits and credits to balance your books.

Digging into Double-Entry Accounting

In double-entry accounting, every transaction involves at least two accounts: one account that’s debited and one that’s credited. Debits and credits should always be equal so your books stay balanced. For instance, debits increase asset accounts such as cash while credits decrease asset accounts such as accounts receivable in equal measure.

Manage debits and credits with your accounting services partner.

Money goes in, and it goes out, but your books still have to be in balance! Debits and credits executed properly keep your company’s financial picture in check. Need an expert accounting services partner to set you on the right path? Get in touch with Ignite Spot to discuss your needs. We’ll develop a customized package to help you hit your financial goals.

.png)

.png?width=160&height=160&name=Gold%20(1).png)