Understanding a Small-Business Cash Flow Statement

Of all of the financial reports a company generates, an accounting cash flow statement is among the most crucial and useful. When a business owner is just starting out, one of the first questions they may have is, “What is a cash flow statement?” As providers of outsourced accounting services, we at Ignite Spot work closely with all of our clients to help them understand their financial situation. We strive not only to keep track of the books efficiently but also to help each entrepreneur further their business goals.

What Is the Purpose of a Basic Cash Flow Statement?

A basic cash flow statement for a small business provides a picture of where a company’s cash has come from and where it is being spent over a set period of time. In other words, by looking at an accounting cash flow statement, it is possible to understand the company’s current cash holdings. The statement also offers a sense of where cash is going and where it’s being made.

Together with an income statement and a balance sheet, the basic cash flow statement is one of the key elements of a company’s financial reports. Since 1987, the Financial Accounting Standards Board (FASB) has required that businesses use a cash flow statement. Unlike an income statement, the accounting cash flow statement does not include details such as depreciation. Therefore, it’s often considered to give a more stripped-down and realistic picture of just how much cash is actually available to a company at any given moment.

The Interpretation of a Small-Business Cash Flow Statement

Knowing how to read a cash flow statement for a small business is a valuable skill. In some cases, a small company may seem to be performing well in terms of sales. However, if the cash flow statement reveals the company to be cash-poor, the business may be in a riskier position. Since it offers such a stark picture of a business’s current viability, one purpose of cash flow statement analysis is for business owners to keep tabs on their business’s overall financial health.

Is a Cash Flow Statement Enough to Tell Whether a Company Is Doing Well?

A cash flow statement does not show the full extent of a company’s profitability, so no, it’s not enough to evaluate a company on its own. It’s actually possible to have a positive cash flow but negative profits: For example, if a company sells off equipment because of flagging sales, its cash flow might look good, thanks to the cash netted from that sale, but its long-term prospects might still be bleak. The cash flow statement is a good start, but you should also examine the company’s income statement to get a better sense of the full financial picture.

What Should a Cash Flow Statement Include?

Most cash flow statements include the following information:

- Cash from operating activities

- Cash from investing activities

- Cash from financing activities

- Disclosure of non-cash activities (optional)

The first category includes operating costs such as merchandise or rent as well as the company’s income. The second category includes long-term assets that the business owner has invested in, such as property or equipment. The third category includes cash received from backers at the company’s founding, including most long-term liabilities or equity.

How Is Cash Flow Calculated?

Cash flow is calculated by starting with your beginning cash balance from the previous statement, then adding or subtracting cash from investments and operating activities, adding cash payments and receipts, and subtracting cash paid to suppliers and cash paid out for salaries.

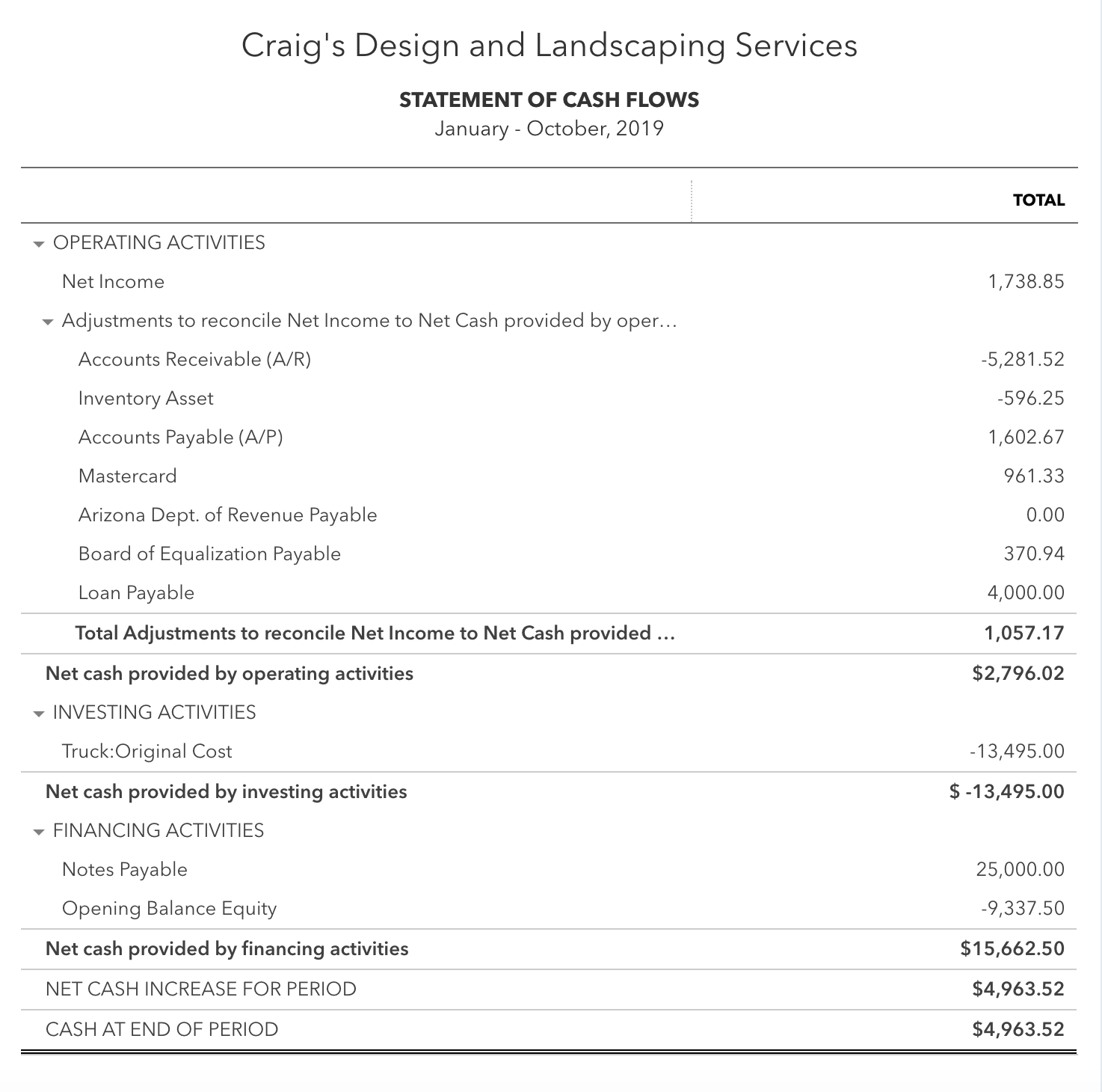

Example of a Cash Flow Statement for a Small Business

Get Help With Your Cash Flow Statements

Knowing how to read a cash flow statement is just one step a business owner should take to take charge of the company’s finances. Outsourcing the company’s accounting and bookkeeping responsibilities to a team of experts is a great way to streamline and delegate these tasks to make sure that they’re managed properly. However, that doesn’t mean that business owners should stay in the dark about cash flow statement analysis. With our firm, it’s easy to download key statements or refer to online materials to stay informed of your company’s overall picture. Contact us today to learn more about how we can help you.

Lean More About Financial Reporting

- What Is an Accounts Receivable Aging Report?

- What Is an Accounts Payable Aging Report?

- What Are Cash Flow Statements?

- What Are Managerial Accounting Reports?

- What Are the Four Basic Financial Statements?

- What Are Common Business Expenses?

- How to Keep Track of Business Expenses

Written by Eddy Hood

.png)

.png?width=160&height=160&name=Gold%20(1).png)